Trading in financial markets involves buying and selling assets for profit, and its key element is opening short or long positions, which are widely used in stock, commodity, cryptocurrency, and currency markets.

Opening a long position means purchasing an asset with the anticipation of its future growth. In contrast, opening a short position involves selling a borrowed asset with the intention of buying it back later at a lower price. These two opposing strategies enable traders and investors to profit from both rising and falling market prices.

The article covers the following subjects:

Key Takeaways

-

A long position involves buying an asset to hold and sell it at a higher price.

-

A short position is a trading strategy of selling a borrowed asset to buy it back at a lower price.

-

Long positions are profitable in bullish markets, while short trades are profitable in bearish ones.

-

You can short stocks or other assets only by using a margin account.

-

The main risk associated with short positions is the potential for unlimited losses if the stock price increases.

What Long and Short Positions Are

Long and short trading are opposite strategies that traders and investors employ to profit in the markets. Long positions involve buying an asset in order to hold it until the price stops rising. In contrast, short positions mean selling a borrowed asset, anticipating a decline to predetermined values.

Long Position

A long position suggests buying an asset, hoping that the price will appreciate. This classic form of trading is common across various markets, including Forex. When traders take a long position, they purchase an asset, such as stock, cryptocurrency, commodity, or currency, expecting the price to climb over time. The main goal is to acquire an asset at a lower cost and lock in profits when the price soars.

A long position is advantageous in a bullish market when an asset’s value is certain to increase in the long term. Holding long positions in stocks can be particularly profitable.

The main advantage of a long position is the theoretically unlimited profit growth potential, as the asset price can rise indefinitely. However, if the price starts to slide, investors may incur losses, especially if borrowed funds are involved.

Short Position

A short position refers to selling an asset that a trader borrows from a broker with the intention of buying it back at a lower price in the future. The strategy is used when a trader expects the market value of an asset to decrease.

Short positions are mostly used in a bearish market when the price of stocks, commodities, currencies, or cryptocurrencies is most likely to drop. Opening a short position requires a margin account, as traders do not own the asset directly but borrow it from a broker.

The main risk of taking a short stock position is that if the price of an asset suddenly starts to rally, the possible losses are unlimited. At the same time, investors are responsible for covering any losses a broker incurs. Therefore, it is crucial to exercise caution when entering short positions.

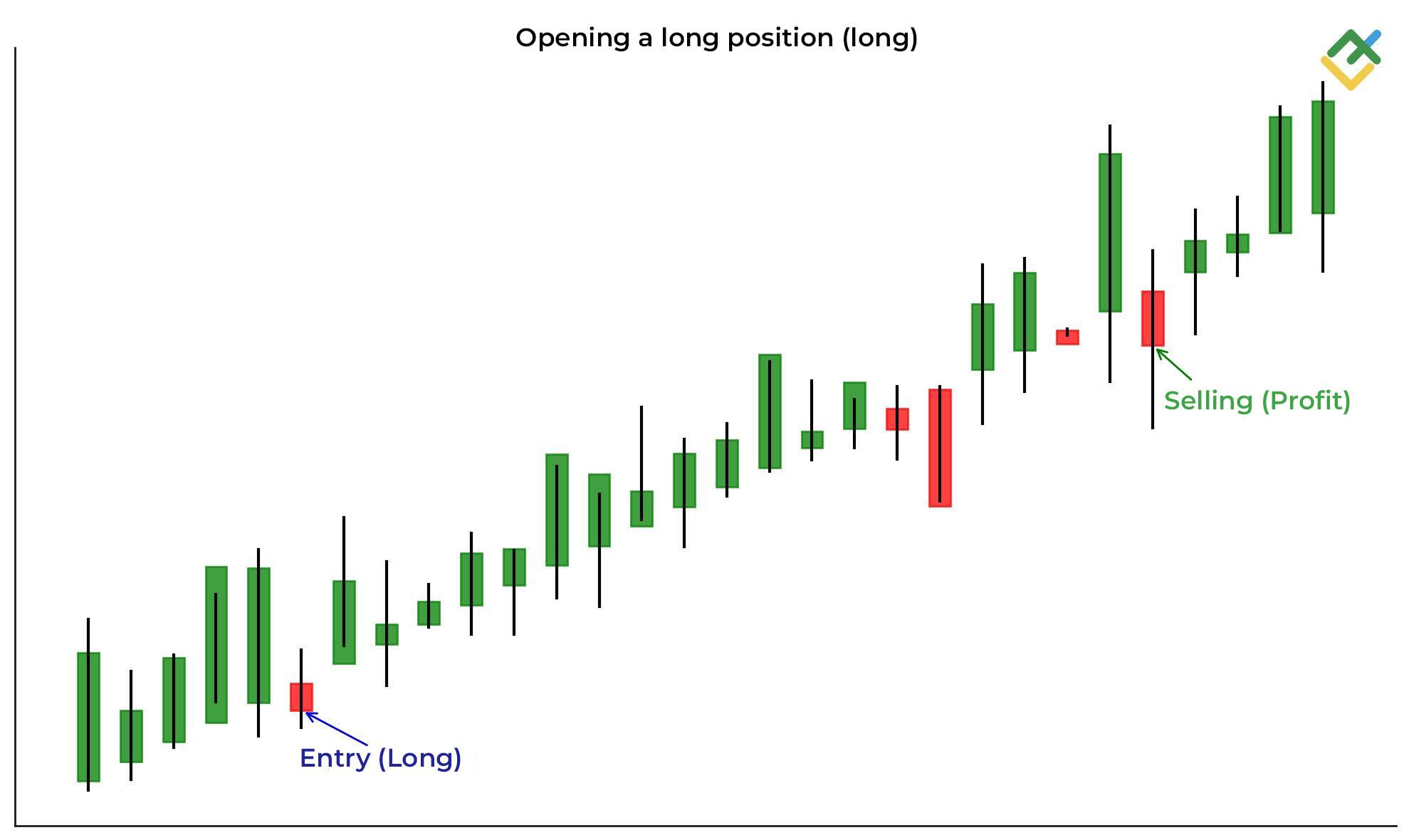

How Long Positions Work

When traders or investors take a long position, they buy an asset, counting on further price growth. This can involve buying stocks, cryptocurrencies, or currencies in the Forex market. Investors buy an asset at a lower price and anticipate it will gain value over time. Long positions are typically favored in bullish markets where growth prospects are strong.

For example, if an investor buys a company’s stock at a closing price of $50 and expects its value to jump to $70, they hold the stock until it reaches that target price, allowing them to sell and secure profits. Similarly, this could involve buying a currency from a pair in the Forex market. For instance, a trader can buy the EURUSD pair, expecting the euro to appreciate against the US dollar.

A long position implies that an investor is interested in the asset’s increasing value and seeks to capitalize on its further growth.

How Short Positions Work

Going short means borrowing assets from a broker with the purpose of selling them at the current market price, expecting it to plunge. After that, traders repurchase the assets at a lower price and return them to a broker, pocketing the difference as a profit. For example, if a trader believes a company’s stock will plummet from $100 to $70, they might borrow the stock, sell it at $100, and then buy it back at $70, locking in a $30 profit. Besides, taking a short position can be used to hedge risk when investors aim to protect their portfolios from price drops.

This strategy is popular in the stock and cryptocurrency markets, where traders typically rely on margin accounts for such operations since only borrowed assets can be involved in short selling. A margin deposit or collateral is placed in a dedicated margin account, with the specific terms and conditions varying, depending on the broker. Additionally, investors should consider the fees and interest they should pay for borrowing assets.

Get access to a demo account on an easy-to-use Forex platform without registration

The Basic Differences Between Long and Short Positions

The main difference between short and long positions in trading is traders or investors’ expectations regarding price movements. Long positions are opened when investors expect the value of an asset to surge. Thus, an asset is purchased with the plan to hold and then sell it back at a higher price. Long positions tend to yield profits in a bullish market, where prices are consistently increasing.

A short position or short selling, on the other hand, is opened with the prospect of a price decline. In this case, traders borrow an asset and sell it at the current price, intending to buy it back later at a lower value to repay the collateral. Short positions are used in bearish markets and require a margin account because assets should be borrowed. You can short-sell various assets, including stocks, commodities, currencies, and cryptocurrencies. However, this strategy carries significant risks, as potential losses can be unlimited if prices suddenly spike.

Therefore, the main difference between these approaches is that a long position focuses on profits from an asset’s appreciation, while a short position aims to benefit from its decline.

|

Parameter |

Long position |

Short position |

|

Expectation |

Price growth |

Price decline |

|

Risks |

Capital loss when prices fall |

Unlimited losses when prices rise |

|

Application |

Long-term investments |

Short-term speculations |

|

Requirements |

Capital for purchase |

Margin account |

|

Potential profit |

Theoretically unlimited |

Limited to an asset’s distance to zero |

What Does It Mean: Going Long vs. Going Short?

Going long or short involves predicting the direction in which an asset’s price will move and trading accordingly. Essentially, going short and long means that an investor or trader is willing to take on risks in pursuit of profit.

A long position is initiated when a trader buys an asset. In other words, an investor anticipates the asset’s value to rise and buys it at the current price to sell it back later at a higher price. This approach is commonly used in a bullish market where the asset is predicted to strengthen.

Conversely, a short position is established when a short seller borrows stock from a broker and sells it at the current market price, expecting the price of a borrowed stock to depreciate in the future. Once the price slides, a trader plans to repurchase the asset at a lower price, return it to the broker, and keep the difference between the sale and purchase as a profit. This strategy is primarily employed in a descending market when the price is expected to weaken further.

Thus, a long position is profitable if the stock price advances, while a short position is advantageous if a stock falls. A short position necessitates a margin account because the assets are borrowed.

Explaining Long and Short Trades

Short and long positions play a key role in trading financial markets. Essentially, any opening transaction is either long or short. However, closing transactions cannot be regarded as long or short, as they can only be made to lock in profits or limit losses.

Long trades are usually associated with positive sentiment when investors expect the price to grow. In this scenario, investors buy an asset expecting it to increase in value so that they can sell it later at a higher price and lock in profits. However, some investors aim to buy at the lowest possible price, hoping to open a trade at what they think is the lowest level, expecting the price direction to reverse soon. This strategy is called countertrend trading and often results in losses.

Short trades or short positions, in contrast, are related to a negative market outlook. In this case, investors anticipate an asset to decrease and open a short position by borrowing assets from a broker and selling them at the current price. Once the price drops, traders buy the asset back at a lower price, return it to the broker, and retain the difference as profit. Besides, opening short positions during a bullish market can also lead to losses when using a countertrend strategy.

Long Trade Example: Buying Low to Sell High

Assume that a trader believes that the value of a company’s stock will rise based on an optimistic market forecast. Consequently, they purchase securities at the current market price, for instance, $50 each.

If the stock price climbs to $70, as predicted, a trader will sell the stock at a higher price. In this case, their profit will amount to the difference between the buying price of $50 and the selling price of $70, which is $20 for each stock.

Short Trade Example: Sell High to Repurchase Low

When traders foresee a drop in stock prices, they can borrow shares from a broker. In return, traders provide the broker with a margin deposit to cover potential losses. Afterward, traders sell a stock at the current market price, which is considered high. Let’s say the price is trading at $100 per stock. If the prediction proves accurate and the price declines, short sellers repurchase the stock at a lower price, for example, $70. The difference of $30 will be the profit.

This strategy can be applied not only to stocks but also to other assets such as cryptocurrency or commodities. The main idea is to borrow assets when their price is elevated, sell them, and buy them back when prices decline.

Risks and Rewards of Long vs. Short

When opening a short position, a trader may face significant losses if the asset’s price surges after it is sold. Since the trader initially borrowed the asset to buy it back at a lower price, any price hikes would increase the repurchase cost, leading to losses exceeding the initial collateral.

The margin deposit that a trader provides to the broker before opening a short position acts as a form of insurance against potential losses. If the price starts to increase, the trader’s losses will grow, prompting the broker to issue a margin warning known as a margin call. Its emergence indicates that a trader needs to deposit additional capital to maintain a minimum margin level. If a trader fails to meet the margin call requirements, a broker can forcibly close the position to limit further losses. Moreover, a broker can close a losing position not at the market price but at the price that is available at that moment. Therefore, you should be very careful when shorting stocks and other assets.

When taking a short position, rising prices heighten the risk, as potential losses can be theoretically boundless. If a margin deposit is insufficient to cover losses, a broker may charge the trader for losses that exceed the margin deposit, including through legal action.

When opening a long position, investor’s losses are limited by capital, as the asset price can potentially fall to zero. This is especially relevant for cryptocurrencies and non-liquid shares of bankrupt companies. However, if a trader opens long positions with leverage using margin collateral, they may suffer unlimited losses.

Copy successful traders

Make profits from the first day of trading without training. The best traders from the whole world gathered on the same platform to share their money-making strategies.

Pros, Cons, and Strategic Uses

Long and short positions have their advantages and disadvantages. Consequently, identifying the right long or short trade is seen as a true skill, as this concept plays a crucial role in portfolio diversification and risk management.

Among the advantages of long positions are their simplicity and the possibility of long-term growth. Investors can gain from the appreciation of the asset, as well as receive dividends if they maintain long positions in stocks. Long positions are suitable for stable and bullish markets. On the other hand, short positions provide the opportunity to profit during bearish markets and help to mitigate risks caused by market fluctuations. Short positions are used in arbitrage strategies where traders make money on price differences between various exchanges.

The disadvantages of long positions include limited profit potential in falling markets and the need to wait for the asset to increase. The drawbacks of short positions are associated with high risks, as losses can be unlimited. Additionally, short positions require margin accounts, increasing costs, and capital requirements.

Effectively using long and short positions enables investors to adapt to different market conditions and capitalize on both rising and falling markets.

Summary

Long and short positions represent the main trading strategies in financial markets. Long positions allow investors to earn on growing prices, while short positions provide an opportunity to generate profits on declining prices. Long positions are more suitable for long-term growth and steady markets, while short positions are used to capitalize on descending markets or hedge risks.

Both approaches have their pros and cons concerning risk and capital requirements. Traders and investors should apply both strategies correctly to optimize the efficiency of the investment portfolio. Besides, do not aim to buy at the lowest price or sell an asset at its peak without borrowing it. Investors trying to catch a falling knife by buying at the bottom often face more losses. Similarly, those who sell prematurely, trying to catch the peak, may end up missing out as the market hits new highs.

Long vs Short Position FAQs

A long position means buying an asset with the expectation of its growth and subsequent selling at a higher price. A short position entails selling a borrowed asset with the prospect of its price falling and its further repurchasing.

A long position implies the growth of an asset, meaning holding it for a longer period of time. A short position involves borrowing an asset for a short period, with the anticipation of its decline, allowing the trader to close a trade quickly.

A long position indicator implies that an investor expects the asset’s price to climb and buys it with the intention of selling it later at a higher price. A short position indicator suggests that an investor expects an asset to drop and sells it, hoping to repurchase it at a lower price.

The decision to take a long or short position hinges on market trends and sentiment predictions. If the price is expected to soar, it is better to choose a long position. Conversely, if the price is forecasted to dip, a short position will be more favorable.

A long forward position involves buying an asset at a predetermined price at a future date, anticipating an increase in value. A short forward position involves selling an asset, expecting it to decline by the time the contract is fulfilled.

When a trader purchases an asset at $50 and later sells it at a higher price of $70, this is known as taking a long position. If a trader borrows an asset valued at $100 from a broker, sells it at the current market price, and then buys it back at a lower price, such as $70, this represents a short position.

In options trading, long positions involve buying either a call option, betting on an underlying asset increase, or a put option, betting on the decrease of an underlying asset. Short positions imply selling an option, committing to buy or sell an asset at the price specified in the contract.

Long positions in derivatives mean buying an asset or contract, hoping that its value will increase. Short positions involve selling an asset or contract with the expectation that its value will decline.

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.