The increasing likelihood of Donald Trump returning to the White House has led to a rise in the value of the US dollar. As a result of rising US Treasury yields, US assets are becoming more attractive, leading to sell-offs in the EURUSD pair. Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Highlights and key points

- Markets return to the Trump trade amid the rising odds of a red wave.

- Polls in favor of Kamala Harris may have been rigged.

- The Fed will pause its rate cut cycle.

- The EURUSD pair may slide to 1.05.

Weekly US dollar fundamental forecast

Despite the fact that Donald Trump’s victory in the US Presidential election has yet to be definitively confirmed, the markets are enjoying a return to the Trump trade. Bitcoin has surpassed the 75,000 mark, hitting a record high. The US dollar has strengthened against major global currencies, the Mexican peso has collapsed by 3%, the US Treasury yield-sensitive yen has weakened, and the EURUSD pair has slumped sharply.

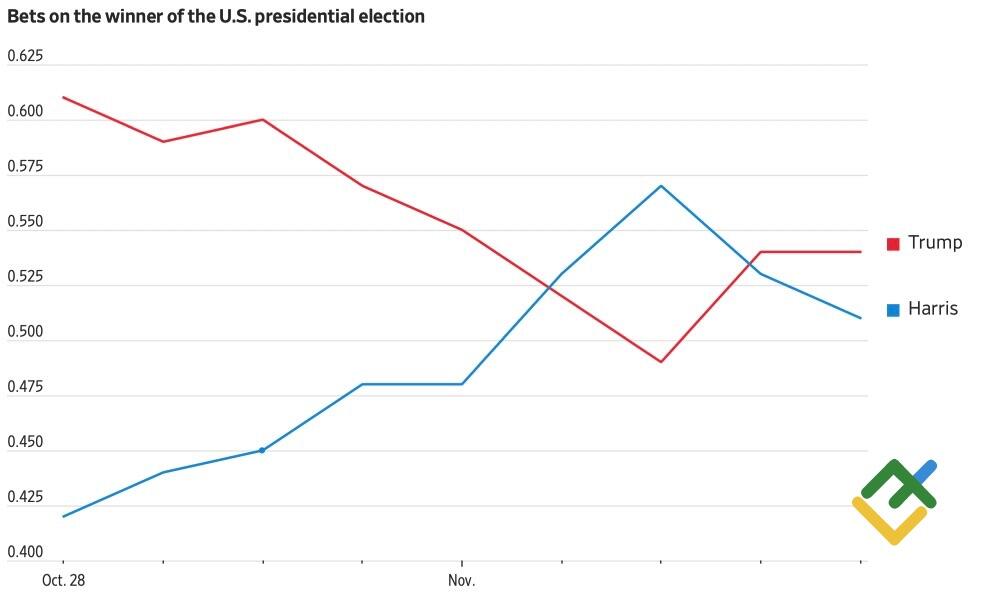

The markets see a victory for Donald Trump, but the question is, What was it? Throughout October, the Trump trade was thriving, but Kamala Harris’ sudden rise in popularity in the polls seemed to turn the tables. The Democrat’s ratings spiked, only to plummet on the eve of the election day. Was someone deliberately manipulating the betting market?

US presidential candidates’ chances of winning election

Source: Wall Street Journal.

In a world where money is king, there are few limits to what can be achieved. In addition to anticipating Donald Trump’s return to the White House, investors should also prepare for a red wave. The Republican Party has gained control of the Senate and is rapidly approaching a majority in the House of Representatives. What implications do these developments have for the financial markets?

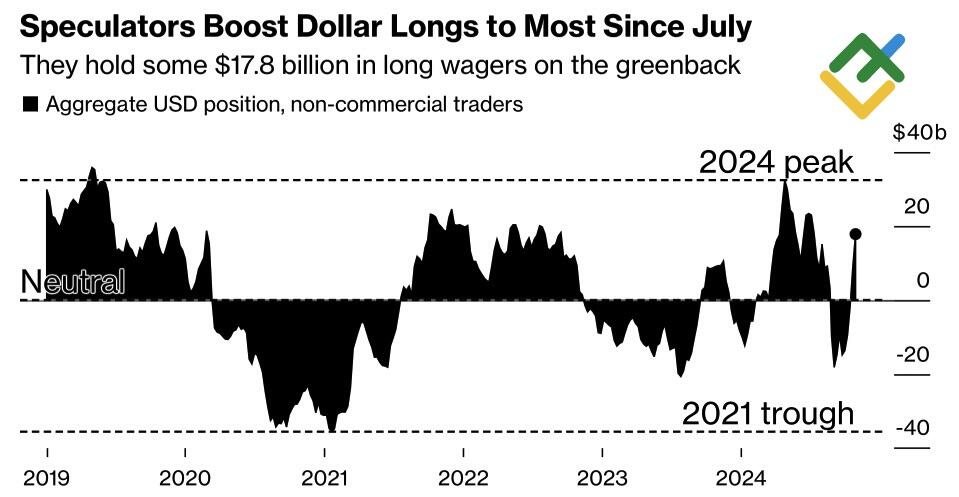

Donald Trump’s policies will likely result in tax cuts and deregulation, which would benefit US stocks. His “America First!” slogan makes a case for purchasing these stocks against European, Chinese, and other counterparts. Increased tariffs and fiscal stimulus will amplify the risks of accelerating inflation and rising Treasury yields. Such an environment is favorable for the US dollar in terms of capital flows into the country due to the high attractiveness of its assets and the growing likelihood of a pause in the Fed’s monetary expansion cycle. Against this backdrop, speculators are actively purchasing the US dollar.

Speculative positions on US dollar

Source: Bloomberg.

As Donald Trump’s election victory approaches, the derivatives market’s bias is changing. It is still confident of a 25 bp cut in the federal funds rate in November, but gives a 30% probability of it remaining unchanged in December. The odds of a January pause have risen to 84%.

The Fed will need time to assess the consequences of a red wave. That said, Donald Trump is certain to put political pressure on the central bank to cut rates. This could lead to turbulence in the financial markets, but Americans have made their choice. The next four years will undoubtedly be eventful.

Weekly EURUSD trading plan

Following the Republican victory, selling the EURUSD pair on a rebound from the resistance level of 1.0905 proved profitable. The pair has reached the first of the two targets of 1.071 and 1.06 set at the end of October. Consequently, the second target can be shifted to 1.05. Consider maintaining your short trades and opening more.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.