Should Donald Trump be elected, the consequences would be less severe for the markets. A similar scenario to that of 2020, when a Republican candidate called for supporters to occupy the White House, has the potential to harm financial markets. Let’s discuss this topic and make a trading plan for the EURUSD pair.

The article covers the following subjects:

Highlights and key points

- Markets are starting to believe in Kamala Harris’ victory.

- It was not just the Trump trade retreat that allowed the euro to rise.

- The stalemate in the presidential race is causing concern among investors.

- Short trades formed on the EURUSD at 1.0905 seem risky.

Weekly US dollar fundamental forecast

As a rule, a market reversal occurs when previous trades are closed. In October, the Trump trade was the primary focus in the markets due to the growing confidence in the success of the Republican Party in the upcoming elections. Imagine that Donald Trump is assuming the role of President of the United States, and his political party is gaining control of Congress. As a result, all proposals put forth by the 45th US President, regardless of their viability, are implemented, leading to a global economic downturn, market instability, and a surge in the value of the US dollar. However, it would appear that EURUSD bulls still have a chance to start a rally.

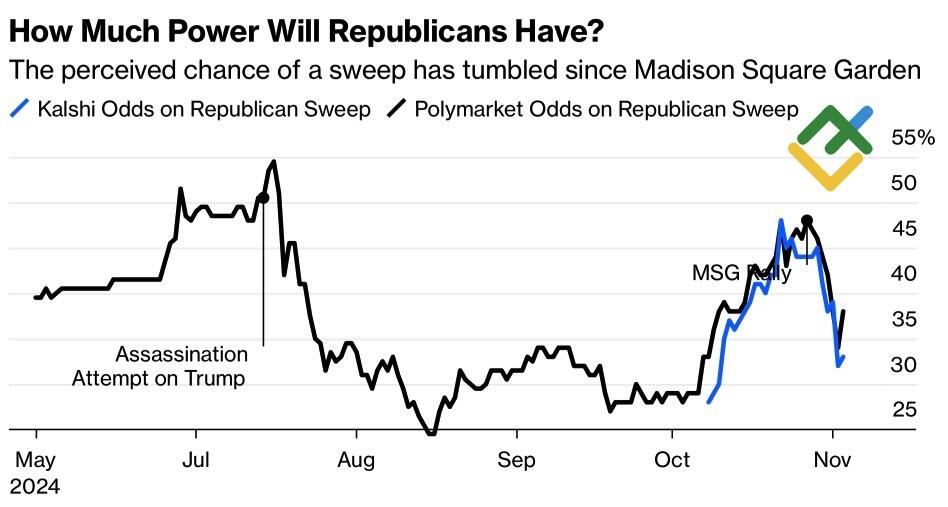

When investors almost dashed their hopes on Kamala Harris, her chances of winning increased because the Republicans may have made a misstep, or the Democrats managed to win the hearts of voters. The fact remains that the decreased chances of a red wave allowed the EURUSD pair to gain some ground.

Red wave odds in US

Source: Bloomberg.

Goldman Sachs has stated that the election victory of Kamala Harris will exert only temporary pressure on the US dollar. Subsequently, a robust US economy and a deceleration in the Fed’s monetary expansion cycle should bolster the greenback.

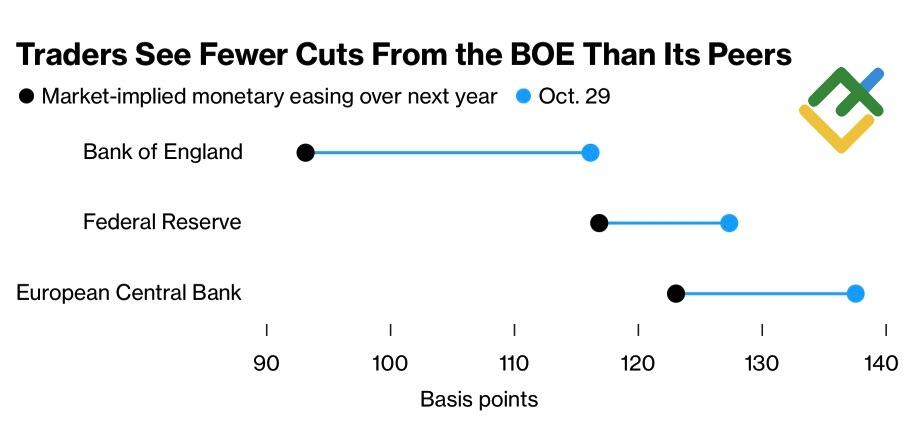

The reversal of the Trump trade is not the sole factor contributing to the EURUSD rally. The budget proposed by the Labour Party was perceived by markets as pro-inflationary, prompting derivatives to reduce the anticipated scope of the Bank of England’s monetary expansion. Strong European GDP and consumer price data allowed the derivatives market to lower the projected scope of the ECB deposit rate cut, providing support to the euro.

Changes in estimated scope of monetary expansion

Source: Bloomberg.

Should Kamala Harris become the new president, the Forex market will resume its usual state of equilibrium. The future of the US dollar and other currencies will be influenced by the monetary policies of the Federal Reserve and other central banks, as well as economic data. However, there are other potential scenarios for how market developments could play out.

Indeed, a multitude of polls indicate that Donald Trump is losing ground not only nationwide but also in key swing states. However, an NBC News poll suggests that the race is tied at 49% each. As a result, the possibility of the 2020 scenario is increasing. At that time, the former US president did not recognize Joe Biden’s victory and called his supporters to take over the White House. Such a scenario would undoubtedly have a significant impact on the markets.

Conversely, Donald Trump’s victory would likely lead to a renewed interest in the US dollar. The introduction of new tariffs and fiscal stimulus measures could result in inflationary pressures, prompting the Fed to pause its monetary expansion cycle. While the president may exert pressure on Jerome Powell and label him America’s enemy, it is unlikely that the Fed chairman will be swayed. He has the backing of the law and the support of his peers.

Weekly EURUSD trading plan

In light of the current market conditions, the positions of EURUSD bears opened at the 1.0905 level appear to be vulnerable. Based on the election results, the pair is likely to fluctuate between 1.07 and 1.1. Therefore, one should decide whether to keep short trades open or refrain from entering the market.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.