The EURUSD pair will likely disregard the US Non-Farm Payrolls for October as hurricanes and strike actions may have distorted the data. In addition, the presidential election is looming in the US. Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Highlights and key points

- The US labor market report could put a crimp in Democrats’ odds.

- Weak employment will increase the estimated scope of the Fed rate cut.

- Positive news from Europe and China allowed the euro to gain ground.

- The EURUSD pair can be sold on a rebound from the resistance levels of 1.0905 and 1.093.

Daily US dollar fundamental forecast

Whoever becomes president of the United States will inherit a strong economy. Due to advances in artificial intelligence and increased productivity, US gross domestic product is expanding at a rate above the historical average, and inflation is approaching the 2% target. The issue is that people tend to remember the extremes, but the middle ground is often overlooked. The Democrats began with a recession and risk ending with the weakest labor market report since the pandemic. Against this backdrop, EURUSD bears may face a more challenging environment.

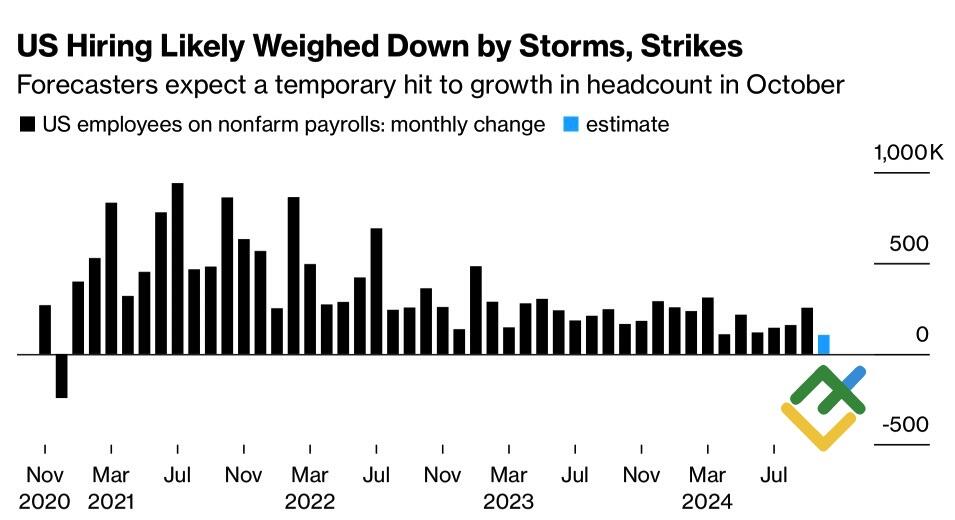

Bloomberg experts have revised their forecasts for October, discounting the impact of hurricanes and strikes and anticipating a 110k growth in employment. Previous estimates ranged from a 10k decrease to a 180k increase. The labor market has been a key strength for Kamala Harris, but the potential for disruption from natural disasters and protests could present challenges.

US Non-Farm Payrolls

Source: Bloomberg.

Weak data could lead to a perception that the Federal Reserve’s monetary policies are more expansive than they actually are. The derivatives market expects a 117-basis-point reduction in the federal funds rate over the next 12 months, representing a 67-basis-point decline from the expectations of early October. As anticipated, the second month of autumn proved to be the most favorable for the US dollar in two years. EURUSD bears managed to showcase an impressive spurt against rising Treasury yields. Nevertheless, bulls appeared to be stronger in the end.

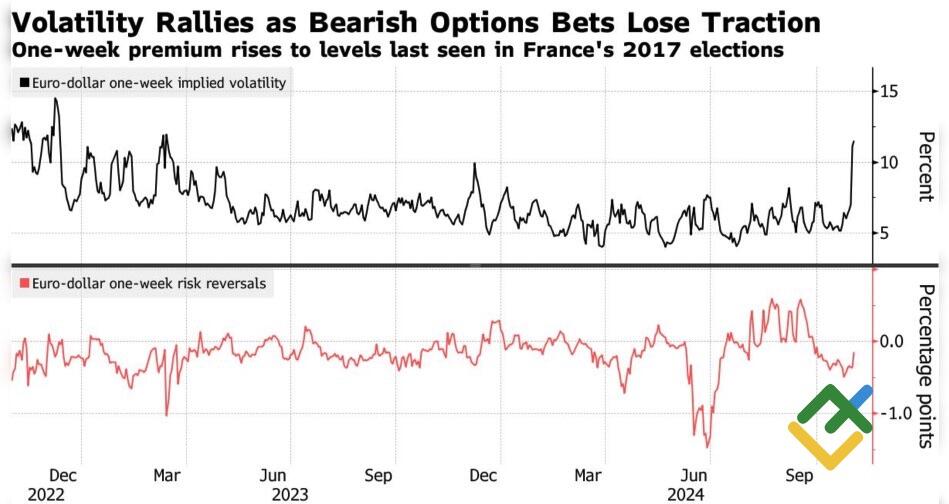

Despite increased euro volatility on the eve of the presidential elections, risk reversals have shifted to the euro’s advantage, although below the zero threshold. The main currency pair has benefited from positive news from Europe and China. What is the projected timeline for this trend?

Euro volatility and risk reversals

Source: Bloomberg.

The EU economy expanded by 0.4% in the third quarter, which, along with inflation returning to the 2% target in October, reduced the probability of a 50 bp cut in the deposit rate in December to 20% from 50%. The latest statistics reinforce the case for gradual monetary expansion and allow ECB officials to maintain a hawkish stance. This is beneficial for the euro, but there are two currencies involved in the pair. The US employment data and then the presidential election may force the EURUSD to revert to its previous trajectory.

The level of foreign exchange volatility has increased to a greater extent than in previous elections for the US presidency. This is due to both uncertainty over the election outcome and concerns over Donald Trump’s policies. Investors are considering the election beyond the US labor market statistics, which is a logical approach.

Daily EURUSD trading plan

Regardless of the final employment figures, the US presidential election is poised to reshape the global economic landscape. When the EURUSD reverts to its trading range of 1.076-1.0865, a strong figure will signal a sell opportunity. Conversely, a weak report may present an opportunity to open short trades on a rebound from the resistance levels of 1.0905 and 1.093.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.