In contrast to Canada and New Zealand, actively reducing interest rates, Australia is adopting a more cautious approach. The country believes a soft landing can be achieved without easing monetary policy. Let’s discuss this topic and make a trading plan for the AUDUSD pair.

The article covers the following subjects:

Highlights and key points

- The Reserve Bank of Australia will not cut rates until February.

- The RBA believes in a soft landing.

- The Trump trade is putting pressure on the Australian dollar.

- Trump’s defeat will allow the AUDUSD pair to bounce off 0.659 or 0.65-0.652.

Weekly Australian dollar fundamental forecast

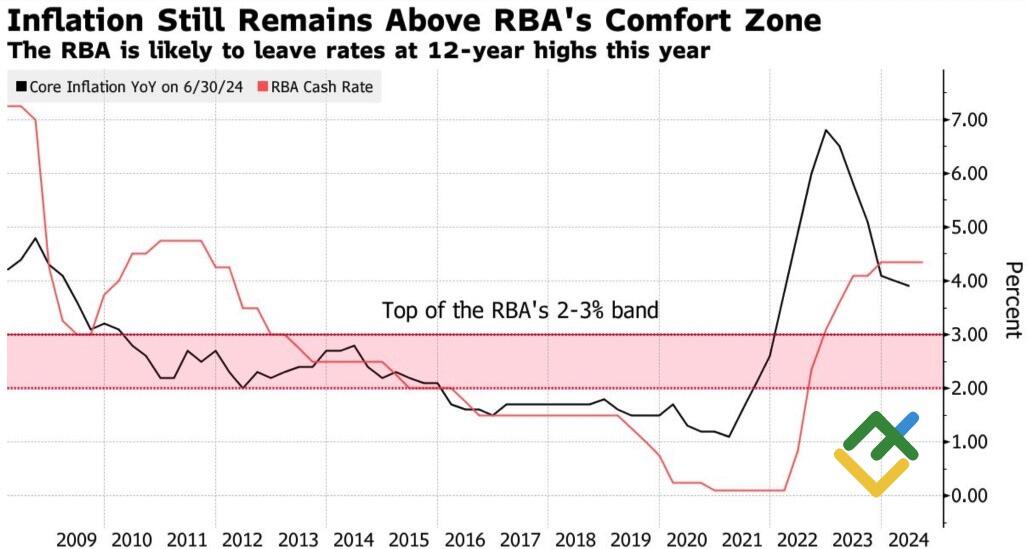

The Reserve Bank of Australia frequently faces criticism for its slow approach to monetary policy tightening. The Australian benchmark rate has climbed to 4.35%, while comparable commodity export-oriented countries such as Canada and New Zealand have raised borrowing costs substantially higher. Consequently, the RBA is still grappling with inflation. However, the RBA’s cautious monetary policy has enabled it to maintain a robust labor market. Unfortunately, this fact does not provide support to AUDUSD bulls.

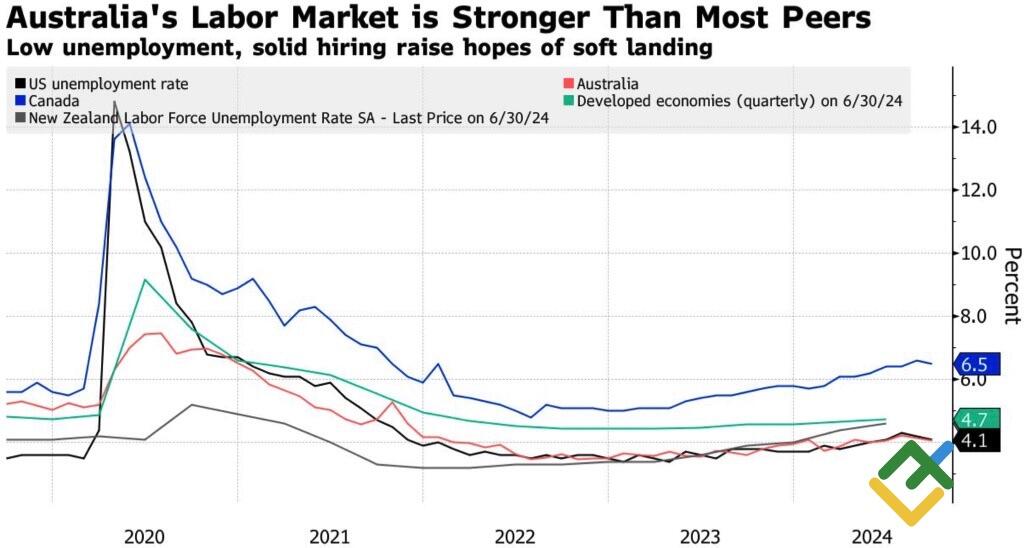

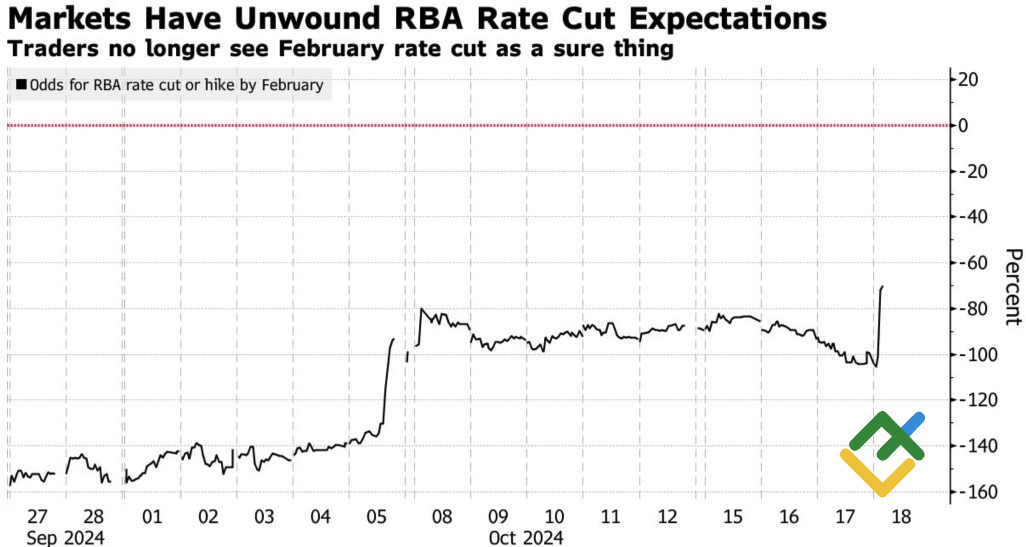

In September, Australian employment grew by 64.1K, more than twice exceeding the forecast of Bloomberg experts. The unemployment rate stood at 4.1%, which is lower than Canada’s 6.5% and New Zealand’s 4.6%. The robust labor market data prompted investors to question whether the RBA would join the global cycle of monetary easing in February. The probability of this occurring has decreased from 100% to 65%.

Unemployment trends in Australia and other countries

Source: Bloomberg.

Cash rate cut likelihood in February

Source: Bloomberg.

Andrew Hauser, Deputy Governor of the Reserve Bank of Australia, has stated that the markets correctly understand the central bank’s intentions. Currently, Australia is reluctant to cut rates, despite the fact that Canada has already reduced them by 125 bp since mid-2024, and New Zealand has cut rates by 75 bp, with another potential cut of 75 bp in November.

While other regulators have managed to tackle inflation by implementing aggressive monetary restrictions, the RBA is much closer to achieving a soft landing for the economy than its counterparts. This is noteworthy, especially considering that Canadian consumer prices have slowed to 1.8%, in contrast to 3.8% in Australia.

Australian inflation and cash rate movements

Source: Bloomberg.

Canberra is witnessing the results of its cautious approach. However, the Reserve Bank’s sluggishness and even its readiness to resume the monetary tightening cycle is not helping the Australian dollar due to the rising popularity of the Trump trade. The Aussie is generally regarded as a proxy currency for the yuan due to its close ties with China. Furthermore, Goldman Sachs’ expectation that the USDCNH pair will reach 8 if Donald Trump returns to the White House exerts considerable pressure on the AUDUSD quotes.

Nevertheless, market participants appear to be overly confident. The Republican candidate has not yet been elected as the next President of the United States. His defeat would provide a catalyst for a rally in the Chinese yuan, Mexican peso, and Australian dollar. Similarly, a Democratic win in the congressional elections would likely have a comparable effect. In such a scenario, Donald Trump will be unable to deliver on all his campaign promises.

Weekly AUDUSD trading plan

However, the AUDUSD pair will remain under pressure until the election results are announced on November 5. Consider holding short trades initiated at 0.67 open and adding new ones on pullbacks. The price may rebound from 0.659 or 0.65-0.652.

Price chart of AUDUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.