The GBPUSD collapse in October was so rapid that Andrew Bailey decided to take action to support the pound. Considering the continued strength of the economy, the decline seems to be overly drastic. Let’s discuss this topic and develop a trading plan.

The article covers the following subjects:

Highlights and key points

- The BoE needs time to assess the results.

- The UK economy is still strong.

- The Trump trade is putting pressure on the pound.

- Sell the GBPUSD pair on pullbacks with the target at 1.284.

Weekly fundamental forecast for pound sterling

Sometimes, central banks may overreact and then attempt to correct their course of action. Just a day after Christine Lagarde caused the pound to drop by stating that the European Central Bank had a clear stance on interest rates and that the speed of any adjustments was the main issue, she opted for a more measured approach, urging the ECB to take a cautious stance. In early October, Andrew Bailey caused the pound to tumble, noting that the Bank of England has the capacity to adopt a more aggressive approach. Three weeks later, the BoE head’s speech allowed the GBPUSD pair to gain ground.

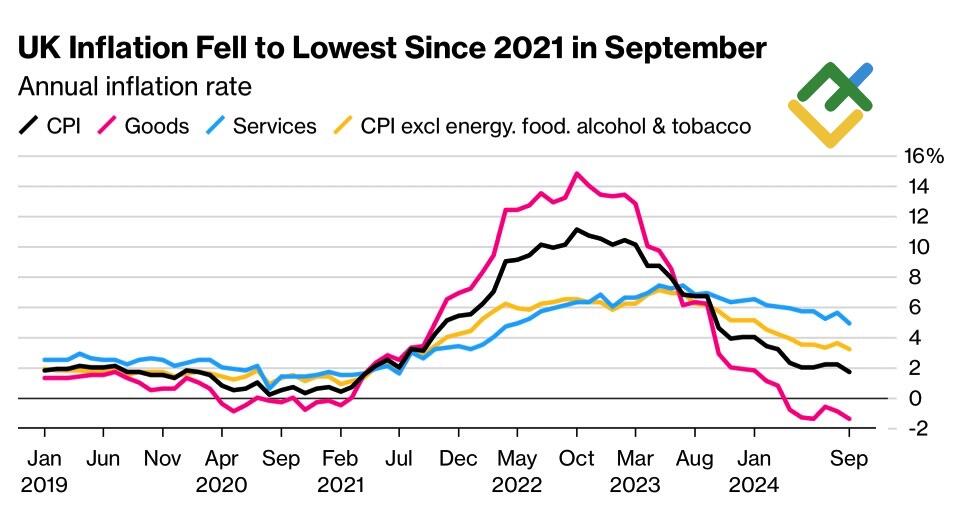

“If you’d ask me what inflation was going to be now, it would have been a bit higher than it is today.” That was Andrew Bailey’s reaction to the UK consumer prices slowing to 1.7% in September. Disinflation continues to gain momentum. However, the Bank of England needs to ensure that there are structural changes in the economy that will drag prices lower. Although the inflation rate dropped from 5.6% to 4.9% in September, it still remains relatively high.

UK inflation performance

Source: Bloomberg.

Andrew Bailey’s speech was favorable for the BoE centrists, who are not eager to reduce the repo rate. Thus, Megan Green believes that the central bank should proceed with caution, given the uncertainty surrounding consumer response to monetary easing. How quickly will they switch from saving to spending? The GDP growth rate and the risks of inflation revival depend on the outcome.

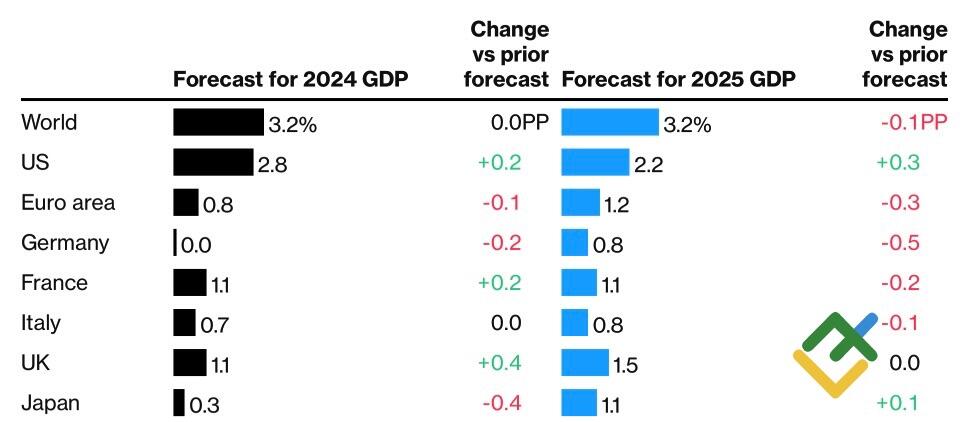

The IMF has revised its forecast for the British economy upwards, anticipating a growth rate of 1.1% in 2024. Concurrently, the authoritative organization highlights the challenge faced by developed nations in stabilizing their financial position without constraining economic growth. This issue is particularly acute for the UK, where the new Labour government is scheduled to present a draft budget on 30 October. The anticipated increase in taxation is exerting pressure on the GBPUSD exchange rate.

IMF forecasts for the world’s leading economies

Source: Bloomberg.

The impact of the Liz Truss government’s mini-budget on the pound sterling in 2022 was significant and has led to concerns that a similar outcome may occur. In any case, the increase in the tax burden and budget spending cuts heighten the risks of a GDP slowdown. The IMF has revised its forecast for GDP growth to 1.5%, which is in line with previous expectations.

The pressure on the GBPUSD pair has resulted in a deceleration of the composite purchasing managers’ index to an 11-month low of 51.7. Thus, investors began to question the robustness of the British economy. Consequently, the data will likely prompt a change in market expectations for the repo rate. Derivatives are predicting a rate cut in November, with a 60% chance of the same outcome in December.

Weekly trading plan for GBPUSD

The GBPUSD pair’s decline is not solely due to factors in Britain. The Trump trade is also pushing the pair lower, driving it towards the first of the two previously set targets of 1.295 and 1.284. The second target is likely to be reached soon. Therefore, consider short trades on pullbacks.

Price chart of GBPUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.