Carbon credit markets have gained significant traction in recent years. These markets are essential tools for reducing greenhouse gas emissions globally. However, they often face a critical challenge: volatility. The instability of carbon credit prices can hinder their effectiveness in emissions trading systems. Fortunately, flexible caps offer an innovative solution to this problem. By adapting to demand, flexible caps stabilize the carbon credit market, enhancing its role in emission reduction efforts. This article delves into how flexible caps can transform carbon pricing strategies and contribute to a more predictable emissions trading environment.

Understanding Carbon Credit Markets

To grasp the importance of carbon credit solutions, it’s essential to understand what carbon credits are. Each credit represents a metric ton of carbon dioxide that’s either reduced or offset. Companies purchase these credits to comply with emission limits. The cap-and-trade system, a popular emissions trading mechanism, facilitates the buying and selling of carbon credits. It encourages companies to minimize emissions while maintaining economic flexibility.

However, the current systems are not without flaws. Market volatility remains one of the most pressing issues. Prices can fluctuate dramatically, making carbon pricing unstable. When carbon credit prices swing unpredictably, businesses struggle with compliance costs and investment decisions. Flexible caps could offer a solution to this problem. By adjusting supply to meet demand, they can stabilize carbon pricing and create a more predictable emissions trading framework.

Market Volatility: A Major Challenge

Market volatility poses significant challenges to the carbon credit market. Fluctuating prices can discourage businesses from investing in emission reduction technologies. When prices spike, companies face higher compliance costs. Conversely, when prices drop, the incentive to reduce emissions diminishes. This unpredictability affects long-term planning and investment in green initiatives.

For instance, both the EU Emissions Trading System (ETS) and California’s cap-and-trade program have experienced significant volatility. In the EU, carbon credit prices surged during economic recovery periods, only to plummet during downturns. These rapid price shifts have led to uncertainty in carbon pricing, making it harder for companies to maintain steady emission reduction efforts. Flexible caps could help by adapting to economic changes and maintaining a more balanced market.

The Innovative Concept of Flexible Caps

Flexible caps represent a shift in carbon credit management. Unlike traditional fixed caps, which set a rigid emissions limit, flexible caps adjust based on projected demand. This adaptive approach helps stabilize carbon pricing. When demand for carbon credits rises, the cap expands slightly, preventing sharp price increases. Similarly, when demand falls, the cap tightens, avoiding sudden price drops.

Implementing flexible caps in auction frameworks is straightforward. Regulators can monitor economic indicators and adjust the carbon credit supply accordingly. This dynamic approach aligns with market conditions, enhancing the predictability of emissions trading. By offering a responsive mechanism, flexible caps encourage steady investment in emission reduction strategies. This leads to a more effective carbon credit market and promotes long-term sustainability.

Benefits of Flexible Caps for Businesses

Flexible caps offer several advantages for businesses operating within the carbon credit market. First, they reduce uncertainty. Stable carbon pricing allows companies to plan long-term investments in green technologies confidently. Predictable emissions trading also encourages businesses to adopt innovative emission reduction strategies.

Secondly, flexible caps improve market resilience. By preventing extreme price fluctuations, they create a more reliable carbon credit market. Companies can better manage compliance costs, leading to greater investment in carbon reduction technologies. This aligns with the broader goal of reducing emissions effectively. Additionally, flexible caps can increase government revenue from carbon credit auctions, creating funds for further green initiatives.

Impacts on Market Stability and Emission Reduction

Flexible caps enhance market stability by adapting to real-time conditions. This approach reduces the unpredictability that often plagues emissions trading systems. With more stable carbon pricing, companies can focus on emission reduction without fearing sudden price hikes or crashes.

The environmental benefits are equally significant. A stable carbon credit market encourages sustained emissions reduction efforts. When companies feel confident in the market’s stability, they are more likely to invest in cleaner technologies. As a result, the flexible cap approach can accelerate the transition to a low-carbon economy.

Expert Insights on Flexible Cap Implementation

Experts in the field of emissions trading have weighed in on the potential of flexible caps. Economists see them as a logical progression in carbon credit systems. According to Dr. John Roberts, an expert in carbon pricing, “Flexible caps offer a realistic solution to price volatility. They align emissions trading with economic dynamics.”

Environmentalists also support this approach. Sarah Green, a prominent climate strategist, notes, “Stable carbon credit markets are crucial for effective emission reduction. Flexible caps could be the key to achieving this stability.” Industry leaders have expressed similar optimism, emphasizing that predictable carbon pricing encourages innovation and investment in sustainable technologies.

Visual Tools to Enhance Understanding

Graphs and charts can help visualize the impact of flexible caps. For instance, a graph comparing traditional cap-and-trade systems with flexible caps would show a smoother price trend under the latter. Simulations can also demonstrate how flexible caps respond to changes in demand, offering clearer insights into their benefits.

Visual tools make complex concepts more accessible to readers. By illustrating market trends and price stabilization, they enhance understanding of flexible caps and their role in emissions trading. Engaging visuals can also highlight the potential for flexible caps to contribute to sustained emission reduction efforts.

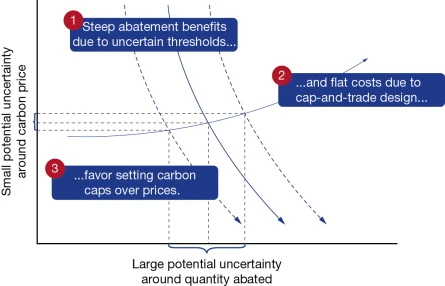

The image shows the uncertainties within cap-and-trade systems, particularly regarding carbon pricing and emission reductions.

- Steep abatement benefits with uncertain thresholds: Emissions reductions can bring high benefits, but outcomes are often unpredictable, making fixed caps less effective.

- Flat costs under cap-and-trade: Traditional systems maintain consistent costs, which can either overshoot or undershoot emission goals depending on market conditions.

- Preference for caps over prices: Due to high uncertainties, flexible caps offer better control by adjusting to real-time demand, leading to more stable carbon pricing and emission reductions.

This visual emphasizes why flexible caps are essential for more adaptive and resilient carbon credit markets.

Conclusion

Carbon credit markets need innovative solutions to remain effective in the fight against climate change. Flexible caps provide a promising way to stabilize markets, encourage investment, and promote long-term emission reduction. By adjusting to demand, they offer a more dynamic approach to carbon pricing and emissions trading.

Now is the time to advocate for such adaptive solutions. Policymakers, businesses, and environmental advocates must collaborate to implement flexible caps in carbon credit systems. Together, we can create a more predictable, sustainable market that supports emission reduction goals. Let’s support these efforts and drive meaningful change in the carbon credit landscape.

Please click here to read our latest article Forex Trading After Hours: Proven Strategies for Night Traders

This post is originally published on EDGE-FOREX.