One may think the ECB did not dare to frighten markets with a 50-point rate cut as investors could suspect a panic. However, the modest cut by 25 basis points will hardly save the eurozone. Let’s discuss it and make a trading plan for EURUSD.

The article covers the following subjects:

Highlights and key points

- The ECB cut the deposit rate by 25 bp to 3.25%.

- The monetary expansion could continue.

- The Central Bank intends to declare victory over inflation in 2025.

- Hold shorts on EURUSD opened above 1.12 and from 1.1045.

Weekly fundamental forecast for euro

Economies behave like wild animals: as soon as central banks try to tame them, they jump in the opposite direction. In 2021, the Fed said that the acceleration of inflation was temporary, but the PCE index did not fall below 3% until November 2023. The banking crisis in the United States in March last year provoked recession talks, but GDP grew by almost 3%. The positive data on the European economy in the first six months was offset in the second part of the year, forcing the ECB to accelerate the cycle of monetary expansion and bringing down EURUSD quotes to 1.08.

Christine Lagarde tried to sound optimistic, saying that the ECB anticipated a soft landing, but that only spooked investors further. The central bank appears to have cut the deposit rate by 25 bps to 3.25% for one reason: to avoid wreaking havoc. A more significant cut could have been seen as a sign that the Governing Council was panicking about an impending recession or the region sliding into deflation. However, even a modest cut was enough to sink EURUSD.

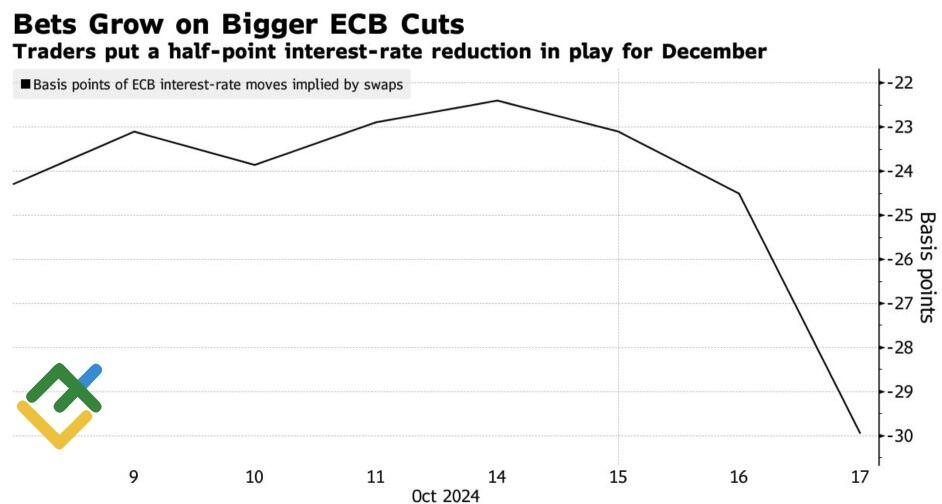

Expectations for ECB’s policy expansion

Source: Bloomberg.

The unanimous decision and the ECB leaving the door open for more cuts allowed the derivatives market to raise the probability of a 50 bp rate cut in December from zero to 20%. Derivatives are pricing in a 25 bp cut at each upcoming Governing Council meeting, including the one in April, even though they had previously only anticipated changes through March. Investors perceived the ECB’s tone as more dovish than expected due to the statement that the process of bringing inflation under control would be completed in 2025. Previously, the second half of next year was cited as the expected period for achieving victory over inflation.

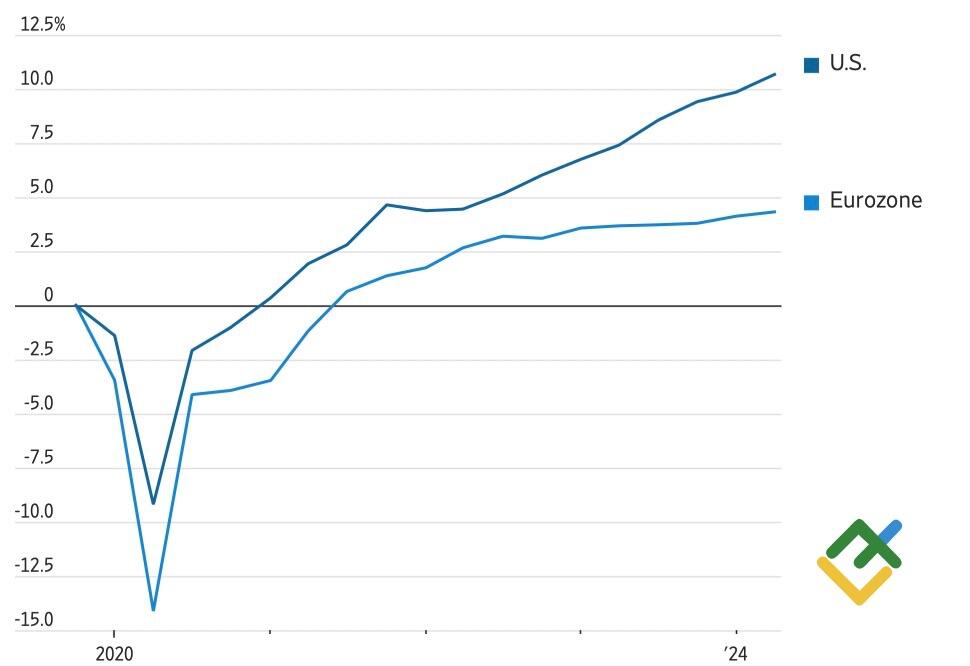

The derivatives market now expects roughly the same monetary stimulus level from the Fed and the ECB – around 140 basis points by the end of the cycle from each central bank. This seems illogical, considering the modest 0.2% growth in the eurozone’s GDP and the increasing risk of a contraction in the third quarter, while the U.S. economy is on track to grow by 3%.

Eurozone’s and U.S.’s Economies Dynamics

Source: Wall Street Journal.

The European Central Bank needs more determination, while the Federal Reserve can afford to be cautious, given the 0.4% acceleration in retail sales in September and the decline in jobless claims. Together, these dynamics suggest that the U.S. economy is on solid ground.

Weekly trading plan for EURUSD

Buy and hold – that is how money is earned. Opening shorts in EURUSD above 1.12 and from 1.1045 proved to be successful. Now, we can ramp them up on possible pullbacks as large players may lock in partial profits. Any trend needs a correction.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.