The Japanese government’s verbal interventions have driven USDJPY 7% up from its September trough amid the strength of the U.S. economy. The officials are now gradually backing away from their attacks on the BoJ. Let’s discuss it and make a trading plan.

The article covers the following subjects:

Highlights and key points

- The Japanese government is not against raising the overnight rate.

- BoJ will not delay policy normalization without reason.

- The potential for the yen to weaken is limited.

- USDJPY growth to 150.7-151 and 152.2 should be used for sales.

Weekly fundamental forecast for yen

Although the Bank of Japan is in no hurry, this does not mean it will unnecessarily delay the normalization of monetary policy. Moreover, government officials seem to have realized that they have gone too far in criticizing the BoJ and have begun to talk about its independence. Their dovish rhetoric has driven up USDJPY quotes by almost 7% since mid-September; however, sharp fluctuations in the pair are not part of Tokyo’s official plans.

According to Prime Minister Shigeru Ishiba, no matter what the government may say, the Bank of Japan makes its own policy decisions. The BoJ Chair and his colleagues have a strong sense of responsibility for achieving price stability. According to insider information from Reuters, they perceive the economy as recovering, which enables them to advocate for the continuation of the monetary tightening cycle amid declining recession risks in the U.S.

When asked about his preference regarding the overnight rate – whether to keep it at 0.25% until the government is confident in overcoming deflation or to increase borrowing costs – Finance Minister Ryosei Akazawa chose the latter option: he trusts the Bank of Japan.

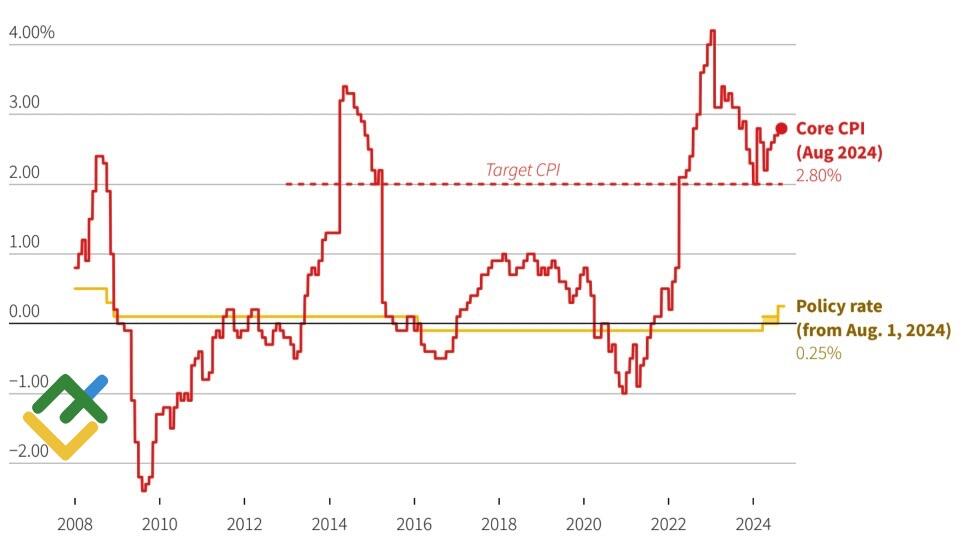

Dynamics of Japanese inflation and overnight rate

Source: Reuters.

Meanwhile, according to Reuters experts, Japanese CPI slowed from 2.8% to 2.3% in September. The indicator has been above the 2% target for over two years, pushing the BoJ towards normalization. It is highly doubtful that the central bank will wait until March. It will most likely increase borrowing costs in December or January, limiting the potential for the USDJPY rally. Mizuho Securities, Nomura Securities, and MUFG Bank, which predict the pair’s growth to 150, believe that the risk of official Tokyo’s new intervention in Forex will increase in this scenario.

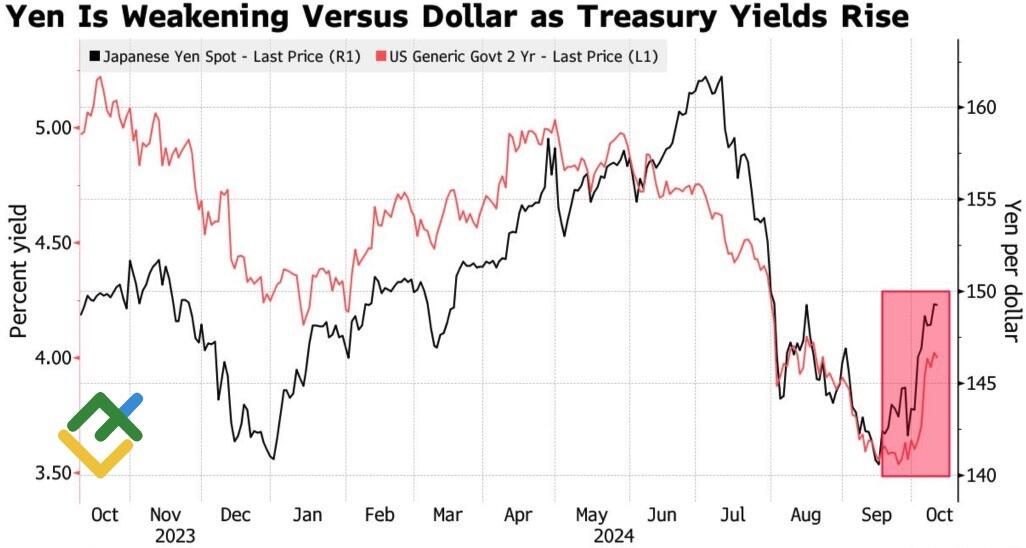

Thus, the government’s verbal interventions, which delayed the terms of a new normalization cycle to 2025, are in the past. Nevertheless, the strength of the U.S. economy and the slowdown in the Fed’s monetary expansion continue to put pressure on the USDJPY bears, which becomes obvious as the pair remains highly sensitive to the dynamics of the U.S. bond yield rates.

Dynamics of USDJPY and U.S. bond yields

Source: Bloomberg.

The question remains: where is the U.S. economy headed? Will it slow under the weight of the Fed’s aggressive monetary tightening in 2022-2023, or will another round of fiscal stimulus from the new president push GDP up? In my view, the first scenario is the most likely.

Unsurprisingly, most FOMC members ignored the September U.S. labor market statistics as a single data point.

Weekly trading plan for USDJPY

This environment suggests locking profits in USDJPY‘s long positions opened from 147,35 as the pair approaches resistance at 150.7-151 and 152.2. Consider selling the pair if quotes reverse near these levels.

Price chart of USDJPY in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.