Thanks to the robust labor market, the US dollar has recorded its longest winning streak since April 2022. The September FOMC minutes did not scare EURUSD bears. Will US inflation be curbed? Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Highlights and key points

- The Fed recalibrated monetary policy in September.

- Some FOMC members were ready to vote for a 25 bps cut.

- If US inflation stops slowing, the rate will remain at 5% in November.

- The EURUSD pair continues to move towards 1.085.

Weekly US dollar fundamental forecast

The Fed recalibrated its monetary policy in September, cutting the federal funds rate by 50 basis points. However, the rate of 5% is also a significant figure given the steady movement of inflation towards the target and the cooling of the labor market in July-August. At the beginning of the fall, it started to heat up, which caused the EURUSD pair to collapse in the conditions of a clear bearish sentiment on the Forex market towards the US dollar.

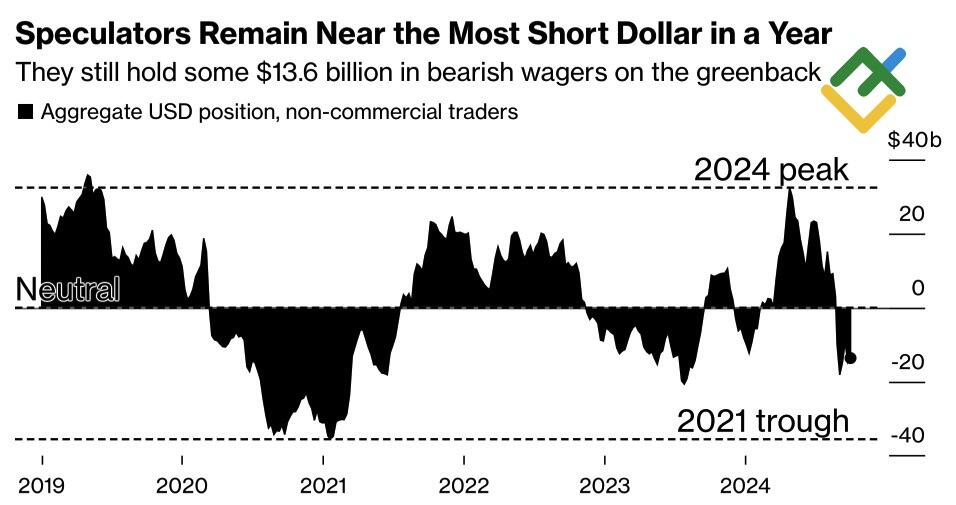

Speculative positions on US dollar

Source: Bloomberg.

In the minutes of the last FOMC meeting, only Michelle Bowman dared to go against the majority by voting for a 25bp cut in borrowing costs. However, her decision was supported by several dovish colleagues who felt that a smaller move might be prudent given the still-strong economy and labor market, as well as inflation running above the 2% target. Moreover, a cautious approach could signal a more predictable path for monetary policy.

The doves, on the other hand, emphasized recalibration and argued that the conditions for a rate cut were already in place in July. After the September US employment report, their views are beginning to change. San Francisco Fed President Mary Daly, for example, said she expected borrowing costs to fall one or two more times in 2024. The futures market is pricing in a 15% probability of no rate cut in November. Overall, the derivatives market expects a rate cut of 44 bps this year, down from 70 bps at the beginning of the month.

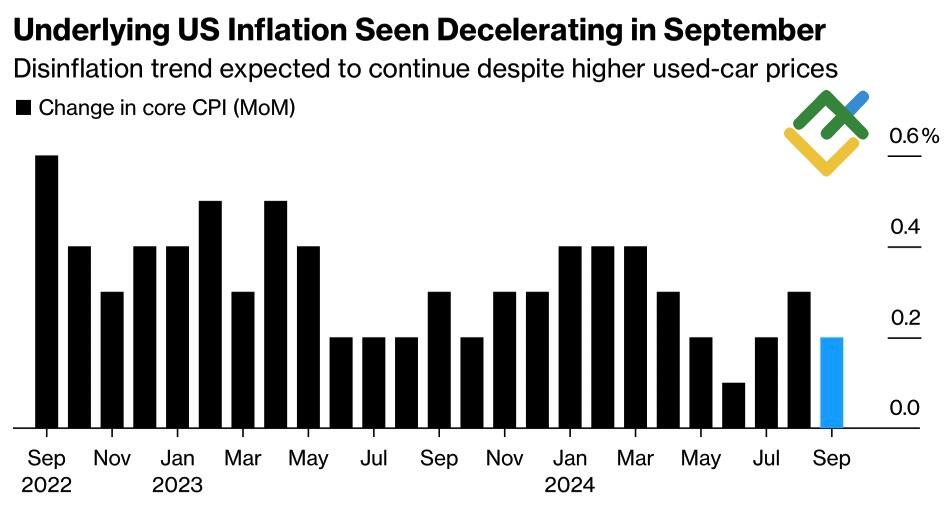

Against this backdrop, the US dollar has managed to mark the longest winning streak since April 2022. Meanwhile, the US inflation report for September may disappoint EURUSD bears. US CPI is expected to slow down to 2.3% y/y and 0.1% m/m, and core CPI may slow to 3.2% y/y and 0.2% m/m.

US inflation change

Source: Bloomberg.

There are growing rumors in the forex market that only a confirmation of the disinflationary process will convince the Fed to cut the federal funds rate by 25 basis points in November. Therefore, the higher the actual CPI data, the more chances the greenback has to continue its rally.

In addition, the European economy looks fragile compared to that of its US counterpart. The German government has significantly lowered its GDP forecast for 2024 from +0.3% to -0.2%. This is the first reduction of the indicator since the beginning of the 21st century and the second since 1990 when the divided country was reunited. The divergence in economic growth and the ECB’s readiness to cut interest rates as early as October 17 push the major currency pair lower.

Weekly EURUSD trading plan

The US inflation report for September is unlikely to support EURUSD bulls. Traders will likely open short trades with a target of 1.085 on the EURUSD pair’s short-term spikes. Therefore, the trading strategy remains focused on selling the euro against the US dollar.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.