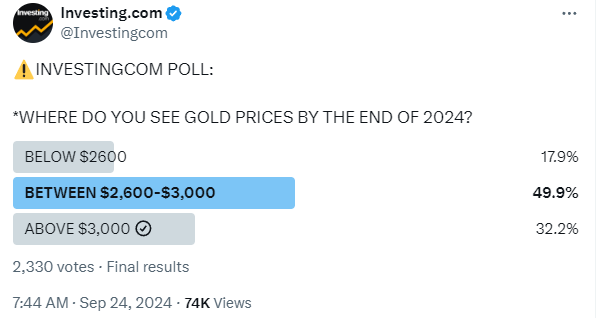

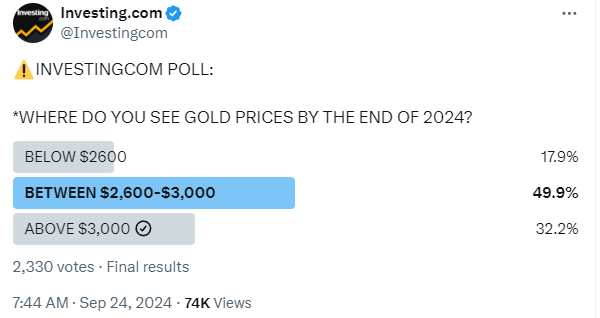

Investing.com — Gold is tipped to trade at between $2,600 to $3,000 by the end of the year, according to a poll of Investing.com readers.

Out of 2,330 votes, 49.9% percent of respondents said they expect the price of the yellow metal to be within that range at the end of 2024. Meanwhile, 32.3% believe it will be above $3,000 and 17.9% expect it to be under $2,600.

By 06:57 ET (10:57 GMT) on Thursday, spot gold rose 0.7% to $2,674.56 an ounce, while gold futures expiring in December climbed by 0.5% to $2,697.60 an ounce.

Underpinning the increase has been a jumbo 50-basis point interest rate cut by the Federal Reserve last week, as well as bets that the central bank will roll out further reductions this year. Lower rates bode well for gold, given that they reduce the opportunity cost of investing in non-yielding assets.

Analysts at UBS have raised their gold price forecasts, saying they now project that gold will reach $2,750 per ounce by the end of 2024, up from its previous outlook of $2,600.

However, analysts at Bank of America flagged that even though gold prices are well above their 200-day moving average, returns are historically “flat 1-6 months after trading at such extremes.”

“Gold investors are also already discounting 150-200 [basis points] of interest rate cuts on our estimation. If Fed cuts are slower than expected, the pace of gold gains could also slow,” the Bank of America analysts wrote.

“Nevertheless, support for prices is clear.”

Investors are now focused on an upcoming address by Fed Chair Jerome Powell on Thursday, while key U.S. economic readings also loomed.

Powell will deliver pre-recorded remarks at the US Treasury Market Conference in New York at 09:20, according to the Fed’s website.

Following the outsized rate cut last week, Powell said the move was a part of a “recalibration” of policy designed to protect the US labor market while sustainably bringing inflation back down to the Fed’s stated 2% target.

Several other policymakers this week have defended the big drawdown, including Fed Governor Adriana Kugler, who said on Wednesday that the rate-setting Federal Open Market Committee needs to “balance its focus” between suppressing price pressures and avoiding “pain” in the broader economy.

But Fed officials have not been unanimous in their support of the size of the cut. Fed Governor Michelle Bowman, who voted for lowering borrowing costs by a more traditional 25 basis points, has said she remains worried by lingering inflation risks.

This post is originally published on INVESTING.