Changing consumer expectations around checkout experiences,

both online and in-store, are reshaping how retailers approach payments and

security across Europe. A new report by payabl. draws on a survey of 1,400

consumers in the UK, Germany, and the Netherlands to explore shopping habits,

payment preferences, and attitudes toward fraud protection.

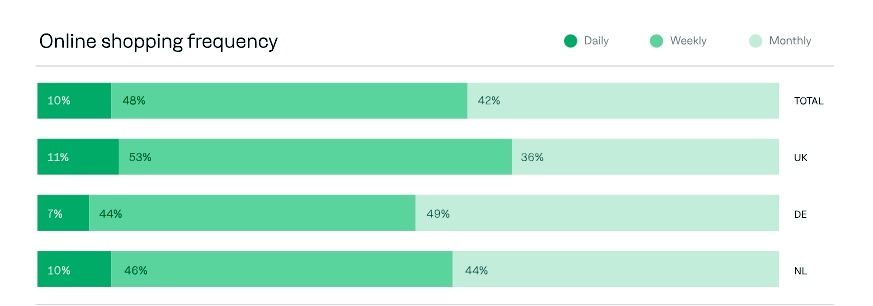

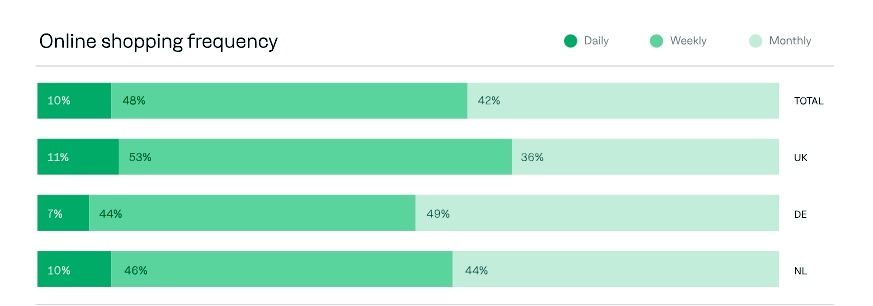

Online Shopping Is Now Routine

Online shopping has become routine for many, with 48% of

consumers shopping online at least once a week and 42% doing so monthly. The

average spend per transaction is £53, while a smaller segment, about 10%,

regularly spends over £100. Most shoppers prefer to plan their purchases rather

than buy on impulse, often combining orders to reduce shipping costs or for

environmental reasons.

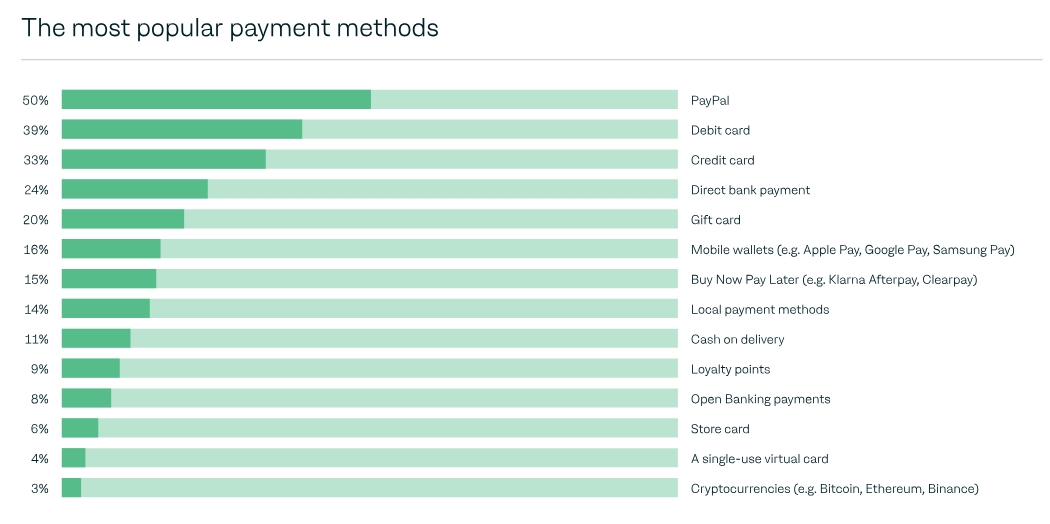

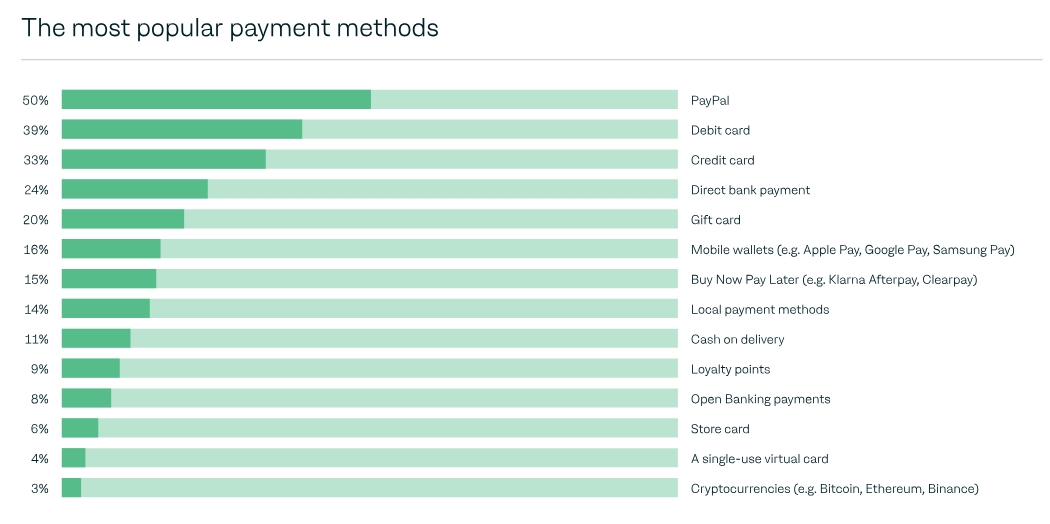

Payment Preferences Vary by Country

Payment choice plays a key role in customer satisfaction.

PayPal remains the most preferred method across Europe. However, preferences

differ by country. In the UK, debit cards are the top choice. In Germany,

PayPal leads by a large margin. In the Netherlands, iDEAL is the most used.

Consumers choose payment methods based on speed, convenience, and security.

Familiarity is less important. Incentives like cashback, discounts, or faster

checkout may encourage shoppers to try new methods.

Cash Still Dominates In-Store Transactions

In stores, cash is still widely used. Sixty percent of

respondents said they prefer cash for in-person purchases. Contactless cards

and mobile wallets follow. Germany shows the highest preference for cash at

67%. This highlights a divide between online and offline habits.

Poor Checkout Drives Customers Away

The checkout experience strongly affects consumer behavior. 43%

of respondents said a poor checkout experience would stop them from returning

to a retailer. Key problems include hidden fees, forced account creation, and

unclear payment steps.

The need for multi-factor authentication was a less

common complaint. Interestingly, 60% of consumers said they had not abandoned a

transaction in the last six months. This differs from retailer data, which

often shows much higher cart abandonment rates.

“The payment checkout experience is a critical. Offering

diverse payment preferences – including cards, digital wallets,

account-to-account and the appropriate selection of localised options – remove

potential barriers to purchase and leave the customer with a suitably positive

feeling about their experience,” David Birch, Global Ambassador for Consult

Hyperion, commented.

You may find it interesting at FinanceMagnates.com: The

Future of Digital Payment Trends Heading into 2025.

Security Concerns Remain High

Security remains a major concern for online shoppers.

According to the report, 71% of consumers are willing to accept a slower

checkout process if it provides stronger fraud protection. However, there is no

clear agreement on who should be responsible for preventing fraud.

While 44%

believe it is the duty of retailers, banks, or payment processors, 25% think

consumers themselves should take responsibility. Another 32% are unsure. This

lack of clarity suggests a need for better communication from businesses about

how fraud protection works.

Interest in One-Click Checkout Grows

One-click checkout is growing in interest. About 48% are

open to using it, but only if it is backed by a trusted provider like Visa or

Mastercard. About 23% said they would not use one-click checkout at all.

The report suggests several steps for retailers. These

include offering local payment options, reducing friction at checkout, and

making all fees clear. It also recommends allowing guest checkouts and clearly

explaining security measures.

Changing consumer expectations around checkout experiences,

both online and in-store, are reshaping how retailers approach payments and

security across Europe. A new report by payabl. draws on a survey of 1,400

consumers in the UK, Germany, and the Netherlands to explore shopping habits,

payment preferences, and attitudes toward fraud protection.

Online Shopping Is Now Routine

Online shopping has become routine for many, with 48% of

consumers shopping online at least once a week and 42% doing so monthly. The

average spend per transaction is £53, while a smaller segment, about 10%,

regularly spends over £100. Most shoppers prefer to plan their purchases rather

than buy on impulse, often combining orders to reduce shipping costs or for

environmental reasons.

Payment Preferences Vary by Country

Payment choice plays a key role in customer satisfaction.

PayPal remains the most preferred method across Europe. However, preferences

differ by country. In the UK, debit cards are the top choice. In Germany,

PayPal leads by a large margin. In the Netherlands, iDEAL is the most used.

Consumers choose payment methods based on speed, convenience, and security.

Familiarity is less important. Incentives like cashback, discounts, or faster

checkout may encourage shoppers to try new methods.

Cash Still Dominates In-Store Transactions

In stores, cash is still widely used. Sixty percent of

respondents said they prefer cash for in-person purchases. Contactless cards

and mobile wallets follow. Germany shows the highest preference for cash at

67%. This highlights a divide between online and offline habits.

Poor Checkout Drives Customers Away

The checkout experience strongly affects consumer behavior. 43%

of respondents said a poor checkout experience would stop them from returning

to a retailer. Key problems include hidden fees, forced account creation, and

unclear payment steps.

The need for multi-factor authentication was a less

common complaint. Interestingly, 60% of consumers said they had not abandoned a

transaction in the last six months. This differs from retailer data, which

often shows much higher cart abandonment rates.

“The payment checkout experience is a critical. Offering

diverse payment preferences – including cards, digital wallets,

account-to-account and the appropriate selection of localised options – remove

potential barriers to purchase and leave the customer with a suitably positive

feeling about their experience,” David Birch, Global Ambassador for Consult

Hyperion, commented.

You may find it interesting at FinanceMagnates.com: The

Future of Digital Payment Trends Heading into 2025.

Security Concerns Remain High

Security remains a major concern for online shoppers.

According to the report, 71% of consumers are willing to accept a slower

checkout process if it provides stronger fraud protection. However, there is no

clear agreement on who should be responsible for preventing fraud.

While 44%

believe it is the duty of retailers, banks, or payment processors, 25% think

consumers themselves should take responsibility. Another 32% are unsure. This

lack of clarity suggests a need for better communication from businesses about

how fraud protection works.

Interest in One-Click Checkout Grows

One-click checkout is growing in interest. About 48% are

open to using it, but only if it is backed by a trusted provider like Visa or

Mastercard. About 23% said they would not use one-click checkout at all.

The report suggests several steps for retailers. These

include offering local payment options, reducing friction at checkout, and

making all fees clear. It also recommends allowing guest checkouts and clearly

explaining security measures.

This post is originally published on FINANCEMAGNATES.