The Federal

Reserve (Fed) has imposed a hefty $44 million fine on Green Dot Corporation, a popular

US-based digital bank, citing a litany of consumer protection violations and

risk management deficiencies spanning at least five years.

Fed Slaps Green Dot with

$44 Million Fine for Consumer Violations

The

Austin-based company, known for its partnership with retail giants like

Walmart, faced regulatory scrutiny for what the Fed described as “numerous

unfair and deceptive practices” that occurred between 2017 and 2022. These

infractions ranged from improperly blocking legitimate customer accounts to

inadequate disclosure of fees associated with tax refund services.

According

to the Fed report, “Green Dot violated consumer law in its marketing,

selling, and servicing of prepaid debit card products, and its offering of tax

return preparation payment services.”

The central

bank highlighted several violations, including Green Dot’s failure to properly

close accounts while continuing to assess fees and the company’s decision to

discontinue phone registration for debit cards without adequately notifying

customers.

The Fed’s

action also mandates that Green Dot implement comprehensive compliance measures

subject to regulatory approval, signaling a broader push for accountability in

the fintech sector.

Green Dot

CEO George Gresham acknowledged

the company’s shortcomings in a statement, saying, ” We’ve been

working closely with our regulators on these matters and are pleased to confirm

the consent order has been finalized.”

However, as

Gresham added, the penalty imposed by the Fed relates to practices used

“years ago,” and since then, the company has undertaken a series of

“meaningful steps” to address these issues. “We remain

optimistic about our financial and regulatory positions as well as our future

growth potential and opportunity as we serve and empower customers directly and

through our partners,” Gresham concluded.

The penalty

was imposed at the time when Green Dot appointed Mellisa Douros as Chief

Product Officer. Previously, she served as the Vice President of Digital

Product Experience at Discover Financial Services and was also associated with

E*TRADE in the past.

Fintech vs. Regulations

The Fed’s

decision comes amidst growing concerns over consumer protection in the rapidly

evolving fintech landscape. As traditional banking services increasingly

intersect with technology-driven solutions, regulators are grappling with how

to ensure fair practices without stifling innovation.

At the

beginning of this year, the need to regulate the sector was highlighted by

Ashley Alder, the head of the FCA, who encouraged other regulators to engage in

global collaboration in this field. Concurrently, the European Union approved

new regulations targeting the payment market, a critical part of the financial

technology industry. These regulations aim to challenge the dominance of major

players such as Visa and Mastercard.

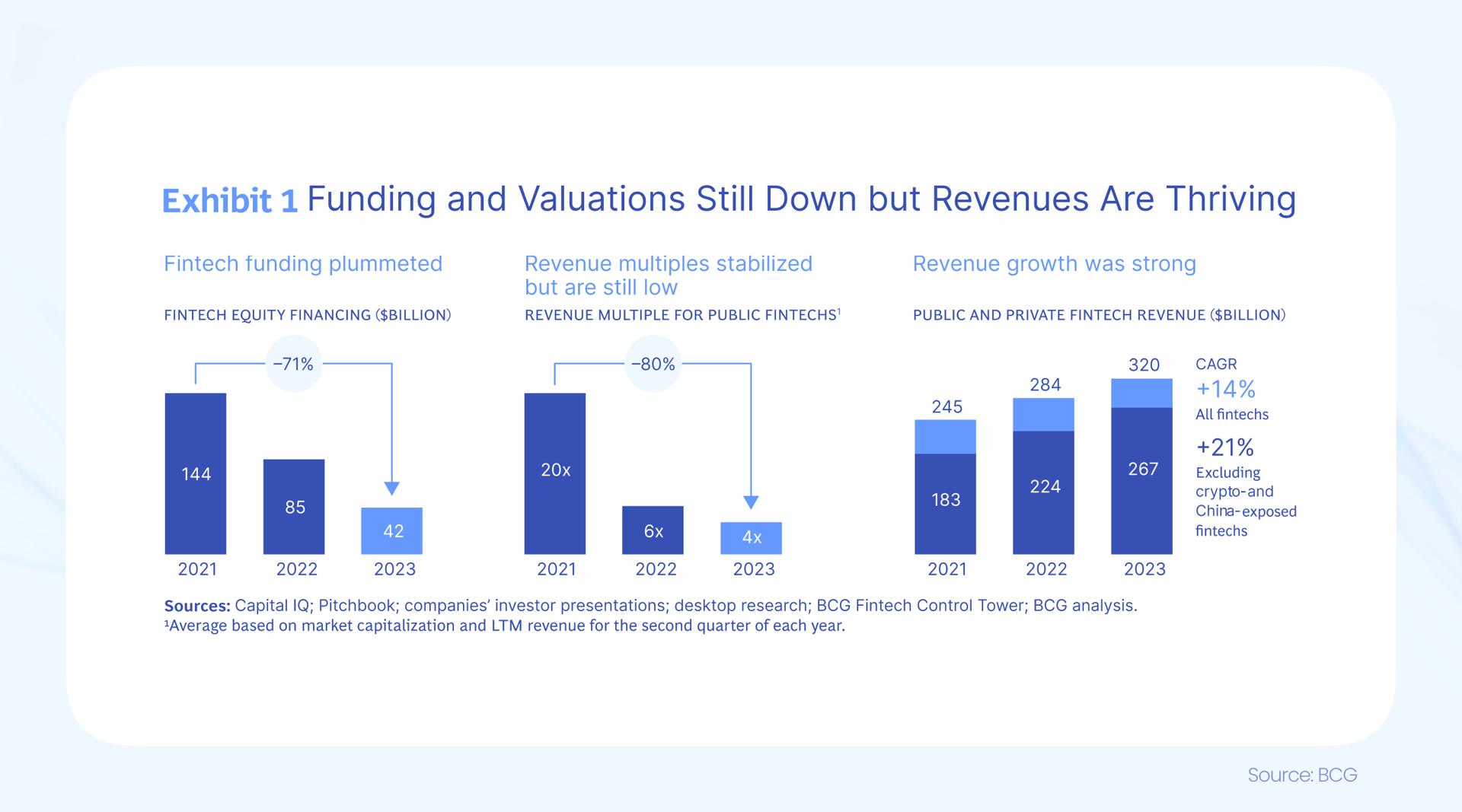

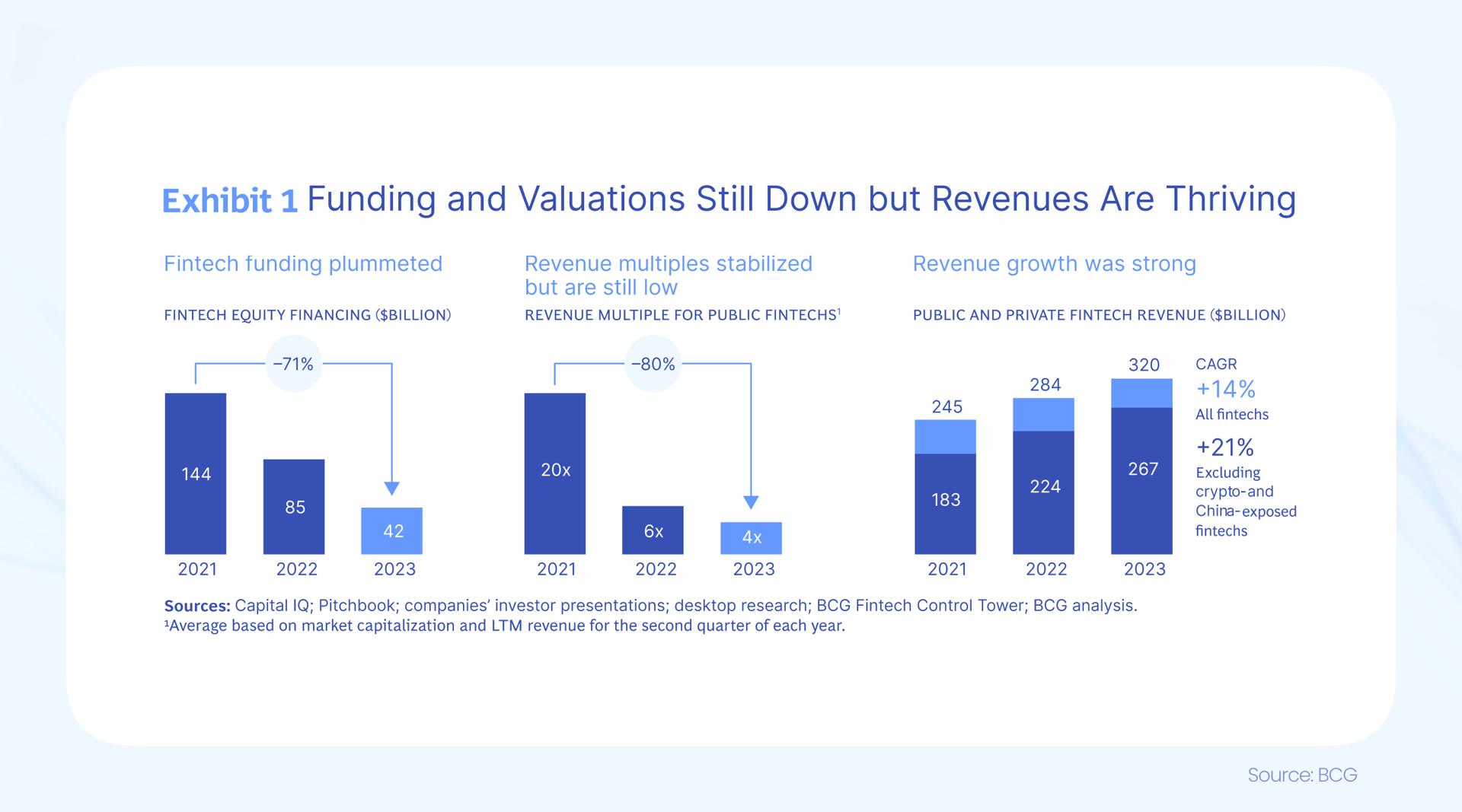

These

developments are taking place at a time when the fintech sector is observing an

increase in revenues, yet there is a significant 70% drop in funding. In

2021, funding amounted to $144 billion, which decreased to $42 billion in 2023.

An

independent report from KPMG, highlighted by Finance Magnates in February,

revealed that 2023 saw the lowest fintech funding results in the past five

years. Global fintech investments fell to $113.7 billion in 2023, a substantial

decline from $196.3 billion in 2022.

The Federal

Reserve (Fed) has imposed a hefty $44 million fine on Green Dot Corporation, a popular

US-based digital bank, citing a litany of consumer protection violations and

risk management deficiencies spanning at least five years.

Fed Slaps Green Dot with

$44 Million Fine for Consumer Violations

The

Austin-based company, known for its partnership with retail giants like

Walmart, faced regulatory scrutiny for what the Fed described as “numerous

unfair and deceptive practices” that occurred between 2017 and 2022. These

infractions ranged from improperly blocking legitimate customer accounts to

inadequate disclosure of fees associated with tax refund services.

According

to the Fed report, “Green Dot violated consumer law in its marketing,

selling, and servicing of prepaid debit card products, and its offering of tax

return preparation payment services.”

The central

bank highlighted several violations, including Green Dot’s failure to properly

close accounts while continuing to assess fees and the company’s decision to

discontinue phone registration for debit cards without adequately notifying

customers.

The Fed’s

action also mandates that Green Dot implement comprehensive compliance measures

subject to regulatory approval, signaling a broader push for accountability in

the fintech sector.

Green Dot

CEO George Gresham acknowledged

the company’s shortcomings in a statement, saying, ” We’ve been

working closely with our regulators on these matters and are pleased to confirm

the consent order has been finalized.”

However, as

Gresham added, the penalty imposed by the Fed relates to practices used

“years ago,” and since then, the company has undertaken a series of

“meaningful steps” to address these issues. “We remain

optimistic about our financial and regulatory positions as well as our future

growth potential and opportunity as we serve and empower customers directly and

through our partners,” Gresham concluded.

The penalty

was imposed at the time when Green Dot appointed Mellisa Douros as Chief

Product Officer. Previously, she served as the Vice President of Digital

Product Experience at Discover Financial Services and was also associated with

E*TRADE in the past.

Fintech vs. Regulations

The Fed’s

decision comes amidst growing concerns over consumer protection in the rapidly

evolving fintech landscape. As traditional banking services increasingly

intersect with technology-driven solutions, regulators are grappling with how

to ensure fair practices without stifling innovation.

At the

beginning of this year, the need to regulate the sector was highlighted by

Ashley Alder, the head of the FCA, who encouraged other regulators to engage in

global collaboration in this field. Concurrently, the European Union approved

new regulations targeting the payment market, a critical part of the financial

technology industry. These regulations aim to challenge the dominance of major

players such as Visa and Mastercard.

These

developments are taking place at a time when the fintech sector is observing an

increase in revenues, yet there is a significant 70% drop in funding. In

2021, funding amounted to $144 billion, which decreased to $42 billion in 2023.

An

independent report from KPMG, highlighted by Finance Magnates in February,

revealed that 2023 saw the lowest fintech funding results in the past five

years. Global fintech investments fell to $113.7 billion in 2023, a substantial

decline from $196.3 billion in 2022.

This post is originally published on FINANCEMAGNATES.